WV DoR CNF-120W 2017-2025 free printable template

Show details

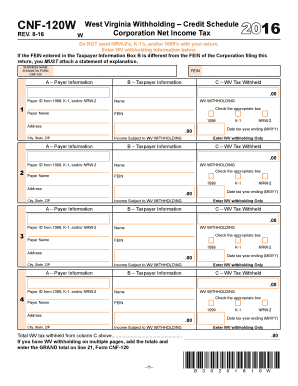

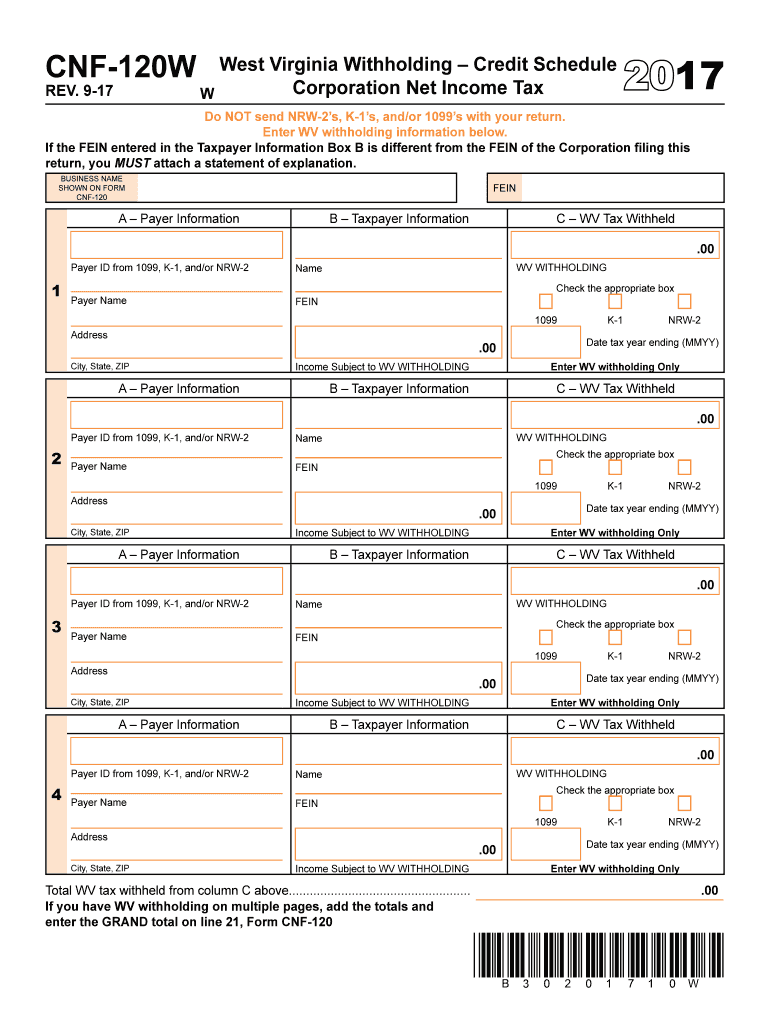

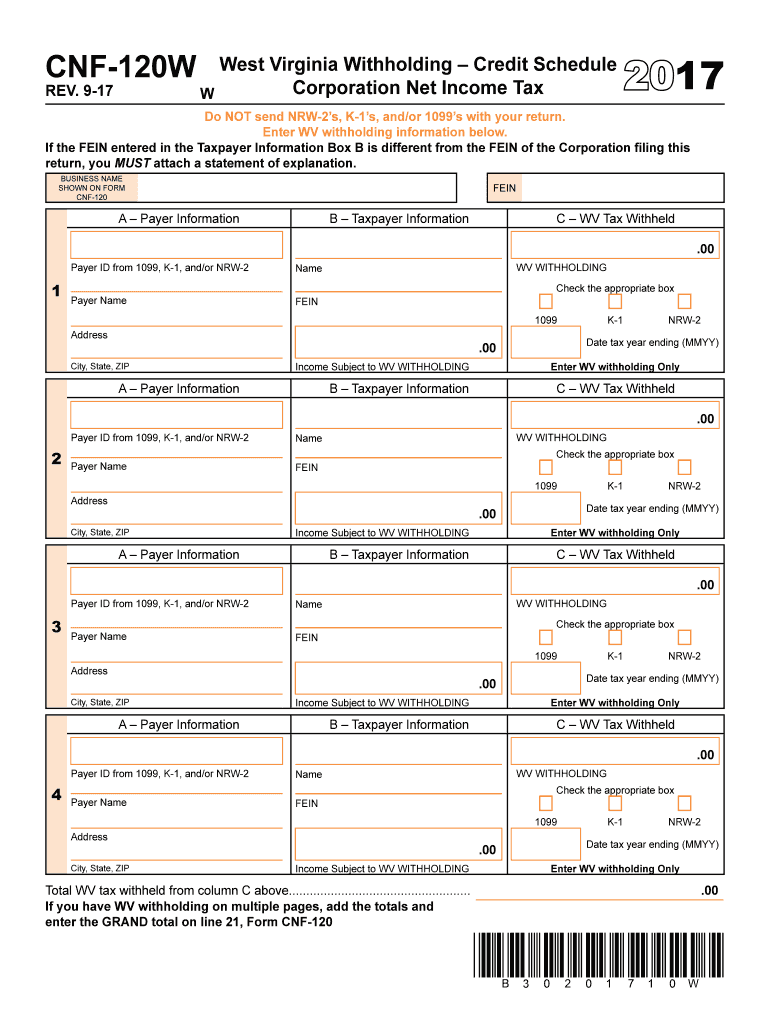

If you have WV withholding on multiple pages add the totals and enter the GRAND total on line 21 Form CNF-120 B30201710W. CNF-120W REV. 9-17 West Virginia Withholding Credit Schedule Corporation Net Income Tax W Do NOT send NRW-2 s K-1 s and/or 1099 s with your return* Enter WV withholding information below. If the FEIN entered in the Taxpayer Information Box B is different from the FEIN of the Corporation filing this return you MUST attach a statement of explanation* Business name shown on...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 120 cnf fillable

Edit your cnf form 120 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 120 cnf form fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 120 cnf fillable online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wv cnf 120 trial form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV DoR CNF-120W Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cnf 120 print form

How to fill out WV DoR CNF-120W

01

Gather necessary documents, including proof of identity and vehicle information.

02

Download the WV DoR CNF-120W form from the West Virginia Division of Motor Vehicles website.

03

Fill in your personal details such as name, address, and contact information in the appropriate sections.

04

Provide the specific details of the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the reason for your application clearly in the designated area.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form and any required documents either by mail or in person at your local DMV office.

Who needs WV DoR CNF-120W?

01

Individuals who are registering a vehicle in West Virginia for the first time.

02

Anyone who is applying for a title transfer for their vehicle.

03

Vehicle owners who are updating their vehicle information with the West Virginia DMV.

04

Citizens applying for a replacement title for their vehicle.

Video instructions and help with filling out and completing west virginia 120

Instructions and Help about cnf fillable 120 form

Fill

form 120 fillable cnf

: Try Risk Free

People Also Ask about fillable form 120 cnf

What is the non resident withholding tax in West Virginia?

The withholding tax rate is 6.5% of distributions of West Virginia source income (whether actual or deemed distributions).

What is the West Virginia General Economic Opportunity Tax Credit?

The Economic Opportunity Tax Credit is generally available for investment placed into service or use over a period of 365 days, beginning on the date when property purchased or leased for business expansion is first placed into service or use.

What is the minimum income to file taxes in West Virginia?

Individuals who have made total payments of $50,000 during the preceding tax year may be required to file and pay their West Virginia taxes electronically.

Do I need to file a West Virginia tax return?

You must file a resident return and report all of your income in the same manner as any other resident individual unless you did not maintain a physical presence in West Virginia for more than 30 days during the taxable year.

Does Virginia require you to file a state tax return?

You must file an income tax return in Virginia if: you are a resident of Virginia, part-year resident, or a nonresident, and. you are required to file a federal income tax return, and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cnf 120?

CNF 120 is an abbreviation that could refer to different things depending on the context. Without more information, it is difficult to determine the specific meaning of "CNF 120." It could be a code, a document number, a product model, or refer to something else entirely.

Who is required to file cnf 120?

CNF 120 is a form that is required to be filed by Claimant's Notice of Filing or Lack of Filing of Court Reporter's Transcript. It is typically filed by the parties involved in a legal case, specifically the claiming party or their attorney, to notify the court about the filing or lack of filing of a court reporter's transcript.

What is the purpose of cnf 120?

The term "cnf 120" does not have a specific meaning or purpose that can be identified without further context. It could refer to a product, a form, a code, or any other subject matter. Without additional information, it is not possible to determine the purpose of "cnf 120."

How to fill out cnf 120?

To fill out a CNF 120 (California Notary Public Application), follow these steps:

1. Visit the California Secretary of State website. Go to their notary public section and download form CNF 120.

2. Fill out the personal information section. Include your full legal name, home address, and phone number. Also, provide your email address (if applicable), your driver's license number, and your Social Security number.

3. Complete the eligibility section. Confirm that you are at least 18 years old, a resident of California, and proficient in English.

4. Disclose any criminal convictions or disciplinary actions against you. Answer the questions honestly, providing details if required. If unsure about any specifics, it is recommended to consult an attorney for guidance.

5. Provide your business address information. If you plan to operate a notary business at a different address than your home, enter the business address here.

6. Fill out the notary education section. Ensure that you meet the required education hours and attach copies of your certificates or other evidence of completion.

7. Select your preferred exam format. Indicate whether you would like to take the notary exam online or by paper form. Note that an additional fee may apply for the online exam.

8. Provide payment information. Fill out the payment section, including credit card details or attach a check or money order made payable to the Secretary of State.

9. Sign and date the application. Read the declaration section and sign your application in blue ink. Make sure to date it as well.

10. Submit the application. Mail the completed CNF 120 form, along with any required attachments and the appropriate fee, to the address provided on the application. Double-check their website for the most up-to-date mailing address.

It's crucial to carefully review the application before submitting to ensure accuracy and completeness.

What information must be reported on cnf 120?

CNF 120 is a customs form used to report foreign trade statistics in the United States. The following information must be reported on CNF 120:

1. Date: The date the form is completed.

2. Exporter Name and Address: The legal name and address of the entity exporting the goods.

3. Consignee Name and Address: The legal name and address of the party receiving the goods in the foreign country.

4. Ultimate Consignee Name and Address: The legal name and address of the ultimate recipient/end user of the exported goods (if different from the consignee).

5. Schedule B/HTS Number: The 10-digit Schedule B or Harmonized System (HS) classification number that identifies the type of exported goods.

6. Description of Commodity: A detailed description of the exported goods, including their characteristics, features, and specifications.

7. Quantity and Unit of Measure: The quantity of goods being exported and the corresponding unit of measure (e.g., kilograms, liters, units).

8. Value: The value of the exported goods in the currency of the transaction (usually reported in US dollars).

9. Weight: The gross weight in kilograms or pounds of the exported goods.

10. Freight: The cost of the freight or transportation charges associated with the exported goods.

11. Insurance: The cost of insurance associated with the exported goods, if applicable.

12. Other Charges: Any additional charges related to the export transaction (e.g., handling fees, customs duties).

13. Country of Destination: The foreign country where the goods are being exported.

14. Port of Export: The US port from where the goods are being exported.

15. Exporter's EIN or IRS Number: The Employer Identification Number or IRS Number of the exporting entity.

16. Exporter's Schedule D/SED or AES ITN: If applicable, the Schedule D/SED number or Automated Export System (AES) Internal Transaction Number (ITN) associated with the exported goods.

17. Signature: The signature of the person completing the form certifying that the information provided is true and accurate.

It is important to note that the specific requirements and format of CNF 120 may vary based on the regulations and practices of different countries and customs authorities.

How do I edit cnf form fillable 120 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your cnf form 120 fillable to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit fillable form 120 cnf on an iOS device?

Create, modify, and share trial wv cnf 120 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit fillable 120 cnf form on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share cnf 120 printable on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is WV DoR CNF-120W?

WV DoR CNF-120W is a form used by taxpayers in West Virginia to report certain types of income and to claim applicable tax credits.

Who is required to file WV DoR CNF-120W?

Taxpayers who have specific income types or are claiming certain tax credits in West Virginia are required to file WV DoR CNF-120W.

How to fill out WV DoR CNF-120W?

To fill out WV DoR CNF-120W, taxpayers should gather all necessary income documents, complete the form with accurate financial information, and ensure all required signatures are included before submission.

What is the purpose of WV DoR CNF-120W?

The purpose of WV DoR CNF-120W is to provide the West Virginia Department of Revenue with information on income that may be subject to state taxes and to claim any allowable tax credits.

What information must be reported on WV DoR CNF-120W?

The information that must be reported on WV DoR CNF-120W includes taxpayer identification details, types of income received, tax credits being claimed, and any other relevant financial information.

Fill out your WV DoR CNF-120W online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Cnf 120 Form is not the form you're looking for?Search for another form here.

Keywords relevant to cnf 120 form fillable

Related to form cnf 120 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.